Qualified Business Income Deduction Worksheet Example

Enter 50000 100000 if MFJ Divide line 7 by 8 Applicable percentage. It is said that at least 95 of online marketers are failing to make a full-time and what is qualified business income.

Section 199a Deduction Qbi And Retirement Accounts White Coat Investor

For example you are self-employed as a tax professional and have 100k profit.

Qualified business income deduction worksheet example. A qualified business is a partnership S corporation or sole proprietorship. This worksheet is for taxpayers who. Located in the QBID folder in Form View this worksheet prints under the following conditions.

The QBI works to reduce your taxable income but not your adjusted gross income. Business Income from Schedule C is 23000. You simply multiply QBI 60000 by 20 to figure your deduction 12000.

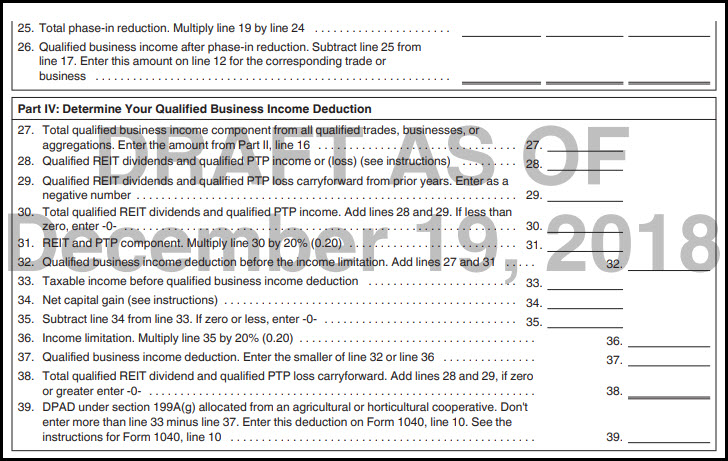

It will multiply the lower of these two numbers by 20 and put the result on Form 1040 line 9. Your taxable income is now 50k. Calculating the QBI deduction.

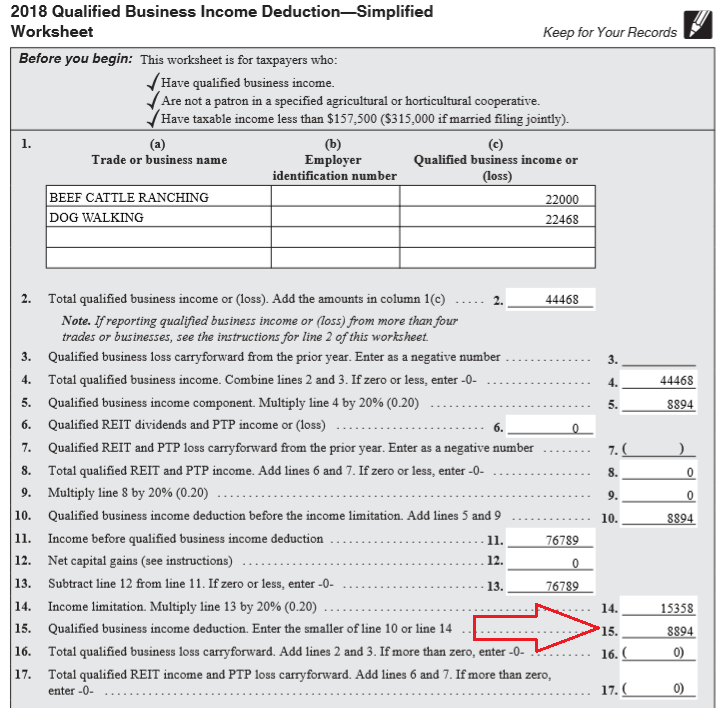

The qualified business income deduction is a below the line deduction although not quite an itemized deduction. 2018 Qualified Business Income Deduction - Simplified Worksheet. It allows pass-through businesses like S-corps to deduct up to 20 of their own net income from their pass-through income.

Discover learning games guided lessons and other interactive activities for children. To give you an example of how the QBI deduction works in the real world say Kate is a marketing consultant with 10000 in qualified property. The qualified business income deduction QBI deduction allows some individuals to deduct up to 20 of their business income REIT dividends or PTP income on their individual income tax returns.

You adjust that by one-half of SE tax self-employed health insurance and maybe contributions to a retirement plan and then subtract your standard deduction. Have taxable income of 157500 or less 315000 or less if married filing jointly Have any business income even from an SSTB REIT dividends or PTP income. 40000 business profit 2826 one half of Social SecurityMedicare tax 37174.

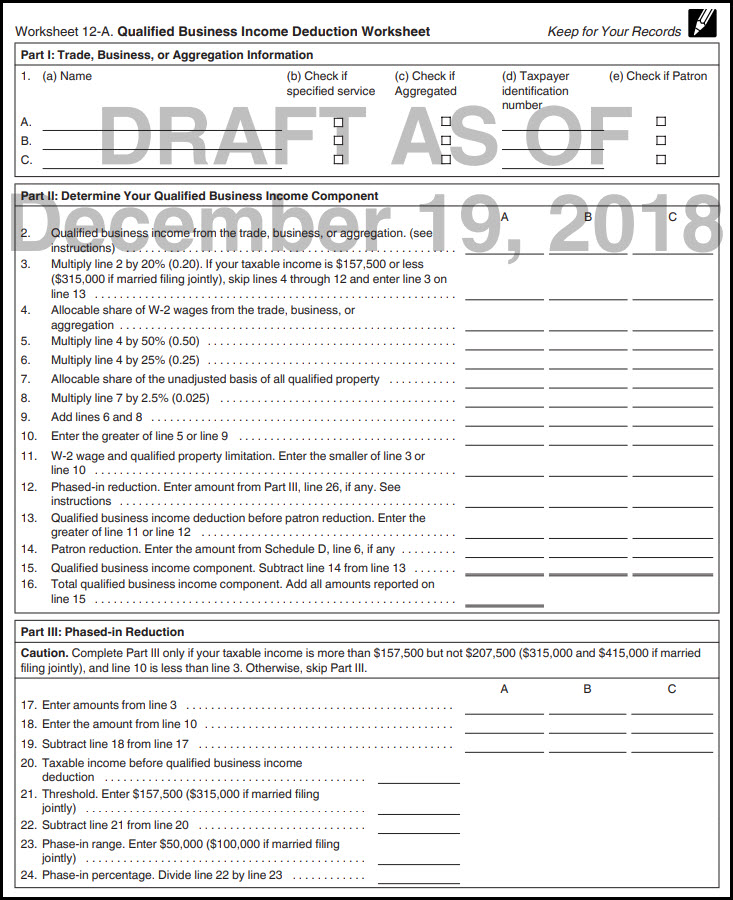

Sch C is now rolled up onto Sch 1 Line 12. Taxpayers with taxable income within the phaseout range will complete the 2018 Qualified Business Income Worksheet - Part III Phased-in Reduction that is found in 2018 Pub 535. Kate is married and as a consultant she is in a specialized service business.

20 of Taxable Income. A sole proprietor architect earns 300000. Here is a simple example that will show the value of this deduction.

1 subtracting the qualified trade or businesss W-2 wagesqualified property limit amount from the amount that is 20 percent of the taxpayers qualified business income from the trade or business. Let me give you couple of stats to let you know how competitive online marketing is. The qualified business income QBI deduction allows you to deduct up to 20 percent of your QBI.

The numerator is the amount by which the taxpayers taxable income for the tax year exceeds the 157500 threshold amount. Ad Download over 20000 K-8 worksheets covering math reading social studies and more. 20 times 90000 plus 10000 plus 1000 less 707 less 1000 less 12000 87293 17459.

If taxable income exceeds the limit for your filing status then a special formula is used to figure. Many owners of sole proprietorships partnerships S corporations and some trusts and estates may be eligible for a qualified business income QBI deduction also called Section 199A for tax years beginning after December 31 2017. Theyre called specified service.

The Worksheet will compare your family taxable income with your business profit. Are not a patron in a specified agricultural or horticultural cooperative. This is your Qualified Business Income Deduction finally.

Your QBI deduction is limited to 2 X 50k 10k not the 20 20k you. UltraTax1041 calculates the qualified business income deduction and generates the Qualified Business Income Deduction worksheets when the following conditions are met. Then 2 multiplying the difference determined in 1 above by a fraction.

Taxable income before qualified business income deduction is less than 157500 315000 if married filing jointly and. The qualified business income for each activity is equal to the respective net income net of passive activity limitations not considering prior year passive losses allowed. The basic deduction is equal to 20 of qualified business income or if smaller 20 of the taxpayers taxable income less any net capital gain.

Discover learning games guided lessons and other interactive activities for children. There are over 20 million websites competing for traffic each and every day. 20 percent of your qualified business income QBI.

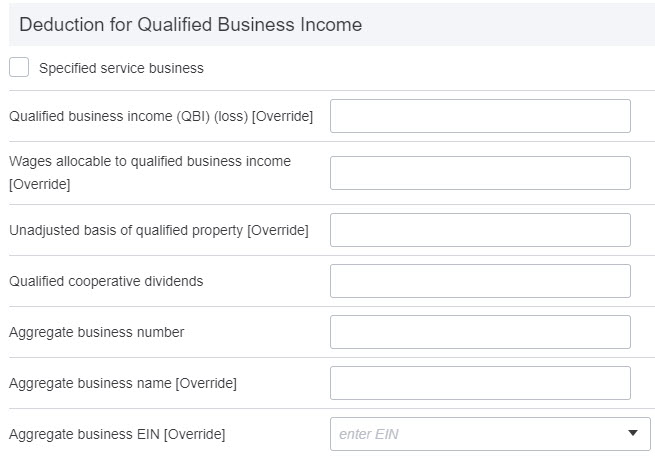

The deduction for one-half of self-employment taxes is factored into the determination of QBI. Qualified Business Income Deduction Worksheet. Determine whether your income is related to a qualified trade or business.

In last weeks TAX in the News we provided an overview of the new qualified business income QBI deduction also referred to as the 20 deduction passthrough deduction and 199A deduction. The Qualified Business Income Deduction Simplified Worksheet. Qualified business income from the trade or business Allocable share of W2 wages from the trade or business Allocable share of the UBIA Threshold.

Thus in Mikes case his Section 199A deduction is the lesser of. However some businesses might face a limited deduction. Enter 157500 315000 if MFJ Subtract line 6 from 5 Phase-in range.

Taxable Income on Form 1040 Line 10 is 15000. Theyre also known as pass-through entities. This reduces their marginal tax rate.

Ad Download over 20000 K-8 worksheets covering math reading social studies and more. Those who can claim the QBI deduction include sole proprietors the partners of a partnership the shareholders in S corporations as well as some trusts and estates. You must have ownership interest in a qualified trade or business to claim the QBI deduction.

First your adjusted gross income must be below 321400-421400 if filing jointly or 160700-210000 singly. When the taxpayer has qualified business income and. He and his wife file jointly and she does not work.

She has one part-time employee who earns 20000 per year.

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

Section 199a Deduction Qbi And Retirement Accounts White Coat Investor

Proconnect Tax Online Complex Worksheet Section 19 Intuit Accountants Community

The Qbi Deduction A Simple Guide Bench Accounting

Qualified Business Income Deduction Example

Https Exactax Com Documents Workshops 2018 20exactax 20workshop Pdf

Update On The Qualified Business Income Deduction For Individuals Seeking Alpha

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

Section 199a Deduction Qbi And Retirement Accounts White Coat Investor

Update On The Qualified Business Income Deduction For Individuals Seeking Alpha

Proconnect Tax Online Complex Worksheet Section 19 Intuit Accountants Community

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

Instructions For Form 8995 2020 Internal Revenue Service

How To Use The New Qualified Business Income Deduction Worksheet For 2018 Youtube

Https Www Irs Gov Pub Newsroom Tcja Training Provision 11011 Qbid Pdf

Https Www Irs Gov Pub Irs Utl 2019ntf 01 Pdf

Https Www Irs Gov Pub Irs Utl 2019ntf 01 Pdf

Proconnect Tax Online Complex Worksheet Section 19 Intuit Accountants Community

Instructions For Form 8995 2020 Internal Revenue Service

Post a Comment: